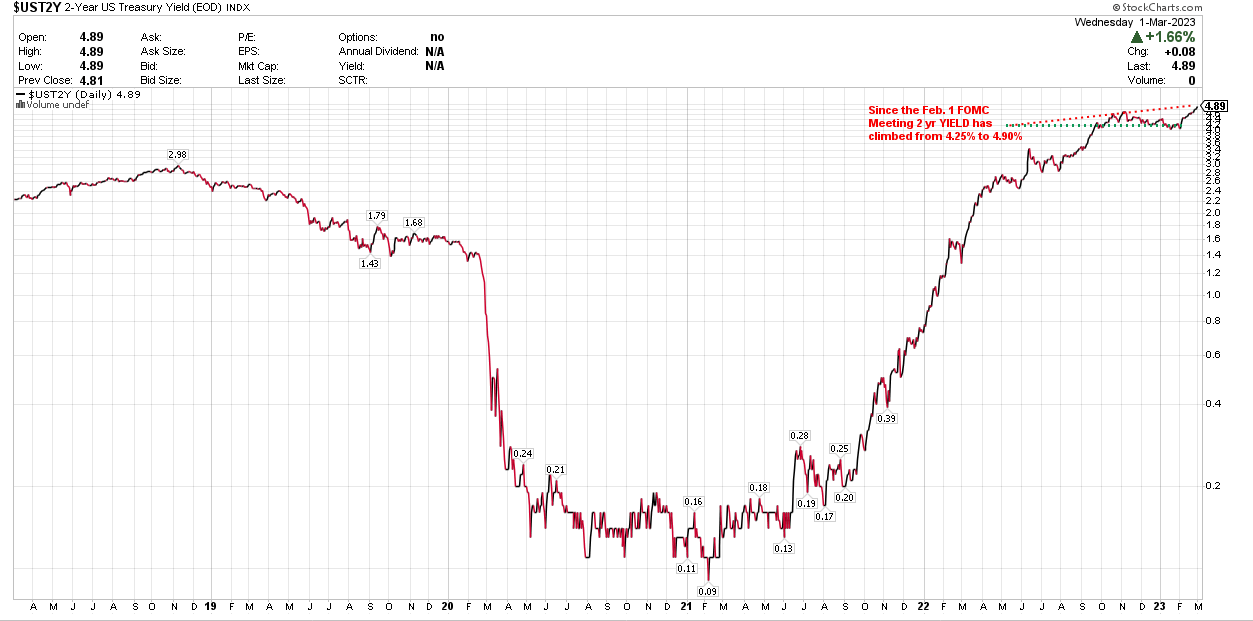

Eye On Yields: Fed Needing To Play Catch-Up?

YIELDs have been rising lately (duh)... 2 Year is pushing up toward 4.80%, up 55 bps since the Feb. 1 FOMC rate hike from 4.25% to 4.50%, which warns us that Fed funds are now below the market, and that the Fed now is in the position of needing to play catch up!

Beneath my 2 Year YIELD Chart is the 10-Year YIELD. During the month of February (remember, the FOMC Meeting was on Feb. 1st), benchmark longer term YIELD climbed from 3.33% to 4.05% today (!) in what looks like the initiation of a new upleg in the larger post-2020 upleg...

Every data point that fails to show the 450 basis points of Fed hiking in the past 12 months is having an impact on reversing (not just slowing) inflation, the more dangerous the situation becomes for the equity markets...