What The Rollover In Yield May Be Telling Us

The Bond Market-- Benchmark 10-year YIELD has plunged from 4.10% to 3.89% (-5%) in the past three sessions, and apart from my pattern work identifying all of the action from the 12/27/23 low at 3.78% to the 1/19/24 high at 4.19% as a counter-trend bounce within an incomplete, larger bear phase from 5.00% (10/23/23), the roll over in YIELD has the right look and feel of a psychological shift in expectations. That is, expectations that EITHER disinflation will continue to accelerate OR that the economy-- in particular, the jobs market-- will begin to show serious cracks in its heretofore impervious armor.

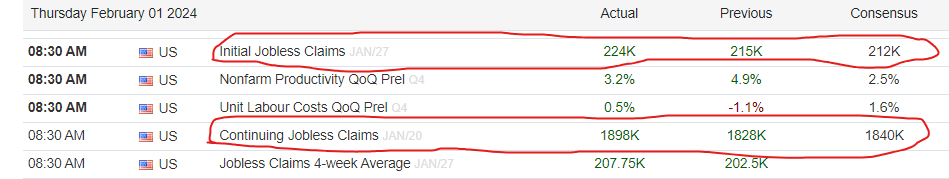

This AM's data on Challenger Jobs Cuts as well as the Weekly Unemployment Claims data hint that such a situation just might be developing.

Wouldn't it be a classic case of Murphy's Law if unemployment started to show a meaningful rise just when Powell decided to "go the extra mile" by staying tighter for longer?

If there is a reason to be ascribed to a resumption of yesterday's stock market weakness (ES) that presses ES to test and violate its dominant October-January up trendline at 4860, then the anticipation of a bout of economic (jobs) weakness, rather than strength, could turn out to be the culprit...

What will Chair Powell do then?