Extreme Technical Levels Point to Equities, Oil Snapback

By Mike Paulenoff, www.MPTrader.com

As we speak, the VIX is trading BELOW its 11/04 low at 44.25, which COULD imply that the e-SPH (890.25) and cash S&P 500, including the SPDRs (AMEX: SPY), are about to take off to the upside. As I noted on Thursday while the VIX was at 44.62 and the e-SPH at 903.50:

"Purely from a chart perspective, the pattern that has developed-- and its near-future implications-- suggests that the VIX has lower values directly ahead-- possibly acutely lower when compared to where it has come from since late-October. Let's notice that during Oct.-Dec. the VIX has carved-out a massive top formation that is testing key intermediate term support between 46.00 and 44.25, which if violated, should trigger downside acceleration towards EITHER 36.50 to satisfy a "swing" target off of the Oct. high OR 23.00 to satisfy the optimal breakdown target off of the massive top formation. As we speak, the VIX is nearing a full-fledged test of its Election Day low at 44.25, while the e-SPH remains about 11% beneath its Election Day high. If the VIX breaks and sustains beneath support, then I have to think that it will continue lower-- and that it will coincide with more additional strength in the equity market. Perhaps a sharply falling VIX will coincide with a retest of the Election Day High in the e-SPH at 1006.25? "

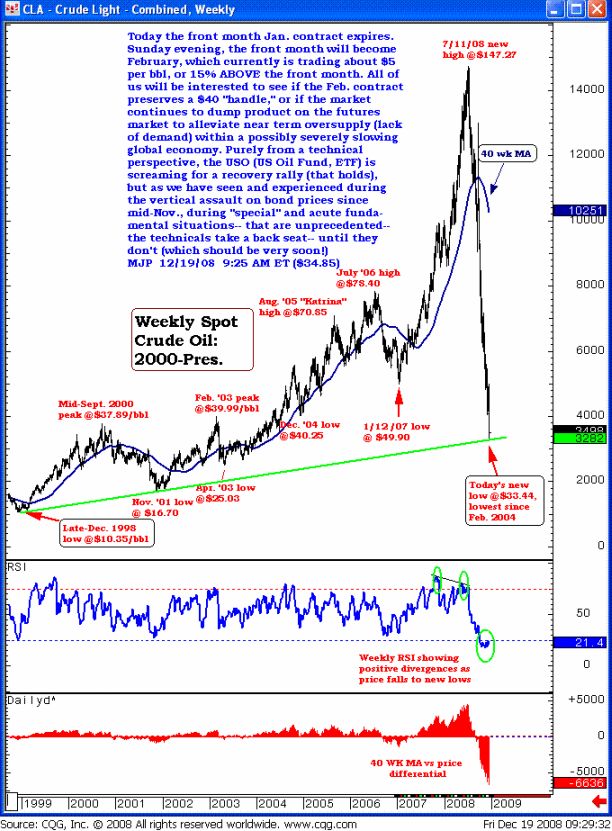

Let us also look today at oil, as today the front month Jan. contract expires. On Sunday evening the front month will become February, which currently is trading about $5 per bbl, or 15% ABOVE the front month. All of us will be interested to see if the Feb. contract preserves a $40 "handle," or if the market continues to dump product on the futures market to alleviate near term oversupply (lack of demand) within a possibly severely slowing global economy.

Purely from a technical perspective, the US Oil Fund ETF (NYSE: USO) is screaming for a recovery rally (that holds), but as we have seen and experienced during the vertical assault on bond prices since mid-Nov., during "special" and acute fundamental situations-- that are unprecedented-- the technicals take a back seat . . . until they don't (which should be very soon!) MJP 12/19/08 9:25 AM ET ($34.85)