10-Year Yield Perched Atop Its Bull Move

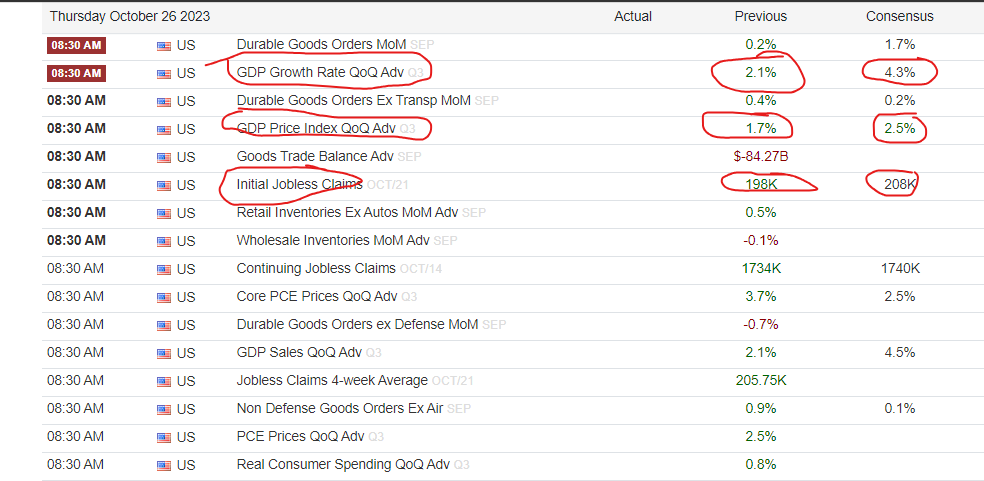

Good Thursday Morning, MPTraders! October 26, 2023-- Pre-Market Update: On the front burner this AM, Economic Data: The first estimate of Q3 GDP and Weekly Jobless Claims (see data table below), both of which are expected to show stronger growth in the overall economy and in the jobs market-- Hardly the results the Fed and investors want to see after 19 months of a rising or higher-for-longer interest rate "normalization" cycle...

As for the macro markets ahead of GDP and Unemployment Claims, 10-year YIELD (see chart below) is perched atop its bull move, pushing up against 5.00%, which if hurdled and sustained, will point to 5.07%-5.11% next, in route to my intermediate-term target zone to 5.35%-5.35%. Only a bout of weakness that presses YIELD beneath 5.87% will provide some relief as well as indications that perhaps a meaningful near-term high has been established...

As for ES, the Head & Shoulders Top formation remains its "elephant in the room," pressing the price structure relentlessly and persistently toward a measured target zone of 4100-4120. The overnight low was 4171, leaving about 1.7% on the downside before the optimal downside potential from the Neckline breakdown plateau at 4400 fulfills its objective. Only a bout of strength that hurdles and sustains above 4240 will trigger near term upside reversal signals...

NQ now becomes the wildcard market, largely because the latest round of tech earnings have pressed NQ beneath its multi-month support plateau, triggering potential downside targets derived from its top formation that project to 1400, and then 13,500 before fulfilling its mission...

More after the economic data...