Another New Multi-Month Recovery High

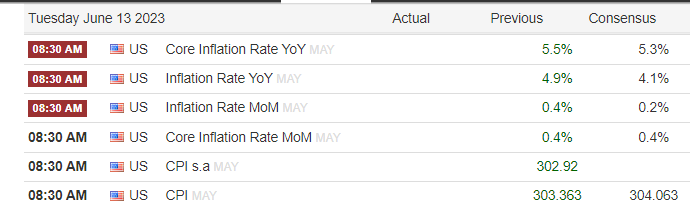

Good Tuesday Morning, MPTraders! June 13, 2023-- Pre-Market Update: May CPI is on deck, which The Street consensus estimates will drop to 4.1% from 4.9% recorded in April. Core CPI is expected to decline to 5.2% from 5.5% in April...

Meanwhile, ES climbed to another new multi-month recovery high at 4402.50 in overnight trading, which satisfies my next target zone (see my attached Hourly Chart). As long as any forthcoming weakness (in reaction to CPI) is contained above 4365/70, the nearest-term dominant uptrend from the 5/31 pivot low at 4218 will remain intact, and as such, we cannot rule out still higher target of 4420/30, and then a test of the August 2022 high-zone at 4450/54.

A breach of second support at 4345/50 is needed to inflict serious technical damage to the nearest-term uptrend... Last is 4390.50... More after the CPI data...