Another Session of Potentially Consequential Economic Data

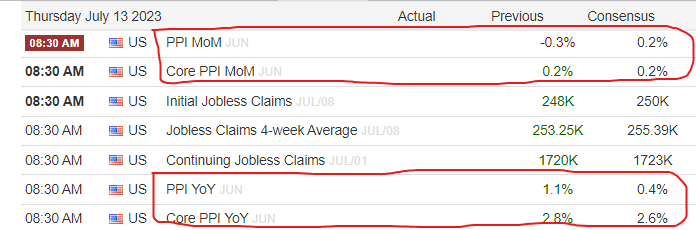

Good Thursday Morning, MPTraders! July 13, 2023-- Pre-Market Update: Another session of potentially consequential economic data on PPI (June) and Weekly Jobless Claims (see table below) prior to the "official launch" of a new earnings season Friday morning (JPM, C, WFC)...

As for the overnight equity futures markets, ES spent the entire session grinding higher to a new post-October recovery rally high at 4525.75.

What now? Purely from a pattern perspective, my work argues that ES is nearing a significant upside inflection point at 4555/60, which represents the Equidistant Swing Target measuring the distance of the October 2022 to February 2023 upleg (+675.50 pts) added to the March 2023 corrective low (3883.25).

If the reaction to this AM's PPI and Jobless Claims data triggers a very positive and persistent upside reaction that propels ES above 4555/60 on a sustained basis during today's session, then my focus will be toward a 4600 next target.

Conversely, if the reaction to the economic data is EITHER positive but unsustainable, OR negative from the outset, and ES presses beneath 4500, my nearest-term work will trigger a reversal warning signal that indicates the index is vulnerable to an "upside exhaustion reversal" that points initially to a potentially important test of the 4440/50 support zone, which includes the sharply up-sloping 20 DMA (see my attached Daily ES Chart)...

Bottom Line: At the moment my pattern and trend work argues for upside continuation to challenge the 4555/60 target zone, which if sustained into today's close will argue for upside continuation toward 4600 into the end of this week (Friday). However, the inability of ES to sustain strength followed by a decline that breaks 4500 will trigger a potentially significant upside exhaustion signal... Last is 4522.75

Lastly, if there is one market that is "warning" me that the reaction to PPI could imply inflation is decelerating rapidly (disinflation is accelerating quickly) it is the Dollar Index (DXY). DXY remains under pressure again this AM, after yesterday's significant 15-month breakdown from a powerful Top Formation. Based on the extremely vulnerable (bearish) technical setup exhibited by DXY, a "surprise" in today's figures will argue that the Fed will have to pause again after its July 26th FOMC meeting (when the market expects a final 25 bp hike in Fed funds)... Last in DXY is 100.22