Awaiting Next Inflation Data Point

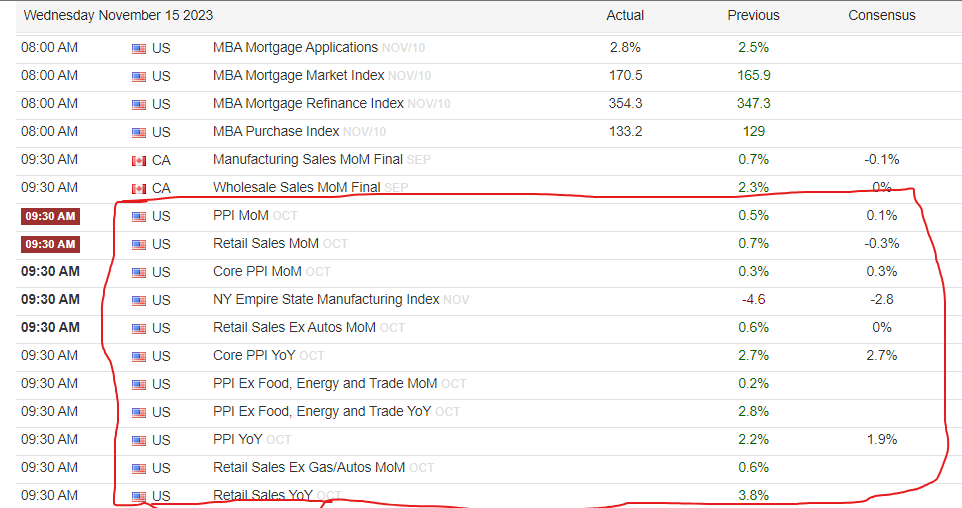

Good Wednesday Morning, MPTraders! November 15, 2023-- Pre-Market Update: PPI is the next inflation-related data point that could keep "the Fed is done raising rates," bullish mantra intact. The Street's estimates are shown below. Otherwise, TGT is up more than 13% in reaction to a beat on every expected metric. My attached 4-Hour Chart shows the powerful upside reaction to the report that has thrust above the down trendine from the April 2022 high at 254.87 that cut across the price axis in the vicinity of 119.50 this AM. Let's see is TGT can hold support above the trendline (119.50) once the first bout of weakness emerges, which will be its first litmus test in the aftermath of an October-November bottoming period... Last is 125.89...

Otherwise, have a look at my posted charts of SPY, which points next to higher potential "magnetized strike prices" at 452-454 on the high side. So far, the vertical post-10/27 upmove from 409.21 has hit a high at 451.09 ahead of this Friday's November OPEX. Should SPY pull back, the first key downside "magnetized strike price" is 448.00... Last is 451.01...

As for NQ, as we speak, it is pushing to test Oct-Nov. highs at 16,000, just 1.6% from fully testing its July 2023 high at 16,259... The reaction to PPI certainly could propel NQ to new highs this AM... last is 15,996...

Note-- The Data Calendar apparently does not turn its clocks back. The PPI and Retail Sales data are released at 8:30 AM ET...