Awaiting Potentially Consequential Inflation Data

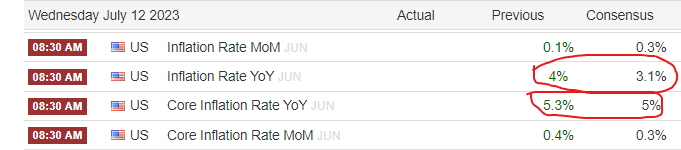

Good Tuesday Morning, MPTraders! July 11, 2023, Pre-Market Update: Everyone awaits tomorrow's June CPI data. The Street expects headline inflation to show a substantial decline to 3.1% annualized versus a 4% annualized figure reported for May.

Judging from the slow methodical upside grind in ES (equity futures) in overnight/pre-market trading (ES now +10.50), traders and investors appear to be leaning toward a positive reaction to tomorrow's inflation figures... (continued below the data table)...

From a Big Picture perspective, ES is trading at 4455.25 as we speak, now 15 points above the sharply up-sloping 20 DMA after briefing trading beneath it very early Monday morning. As long as ES remains above the 20 DMA on a closing basis, the near term uptrend will represent the dominant direction.

From a more granular nearest-term pattern perspective, my attached Hourly Chart shows that the price structure has climbed from yesterday's early AM low at 4411.25, which briefly violated the 20 DMA at that time, to a high of 4457.25-- just shy of a full-fledged challenge of the near-term resistance line (4460) off of the 6/30 recovery rally high at 4498.00.

At the moment, considering tomorrow's potentially consequential inflation data, let's consider ES confined to a contracting but bullish range between 4460 on the high side versus 4415 on the low side that might last for the next 23+ hours ahead of tomorrow's CPI report...

That said, barring some surprisingly negative catalyst, my pattern work argues for an upside resolution to the sideways rangebound ES market that projects to the 4540/60 target zone next.

Only a breach of nearest support from 4415 to 4411 will weaken the current setup... Last is 4455.00