Big Focus This Week On Earnings

Good Monday Morning, MPTraders! November 3, 2025-- Pre-Market Update...

-- Today is day #34 of the Government shutdown... Two federal judges have ruled that the Trump Administration must continue SNAP and subsistence payments later this week... There are social media comments that the Senate Democrats are betting that angry and "hangry" New Yorkers will sweep "Democrat Socialist" (some say Communist) candidate Zohran Mamdani into office tomorrow evening, and thereafter, will pass the Continuing Resolution as is, in a Senate vote on Wednesday ... (crazy politicians!)...

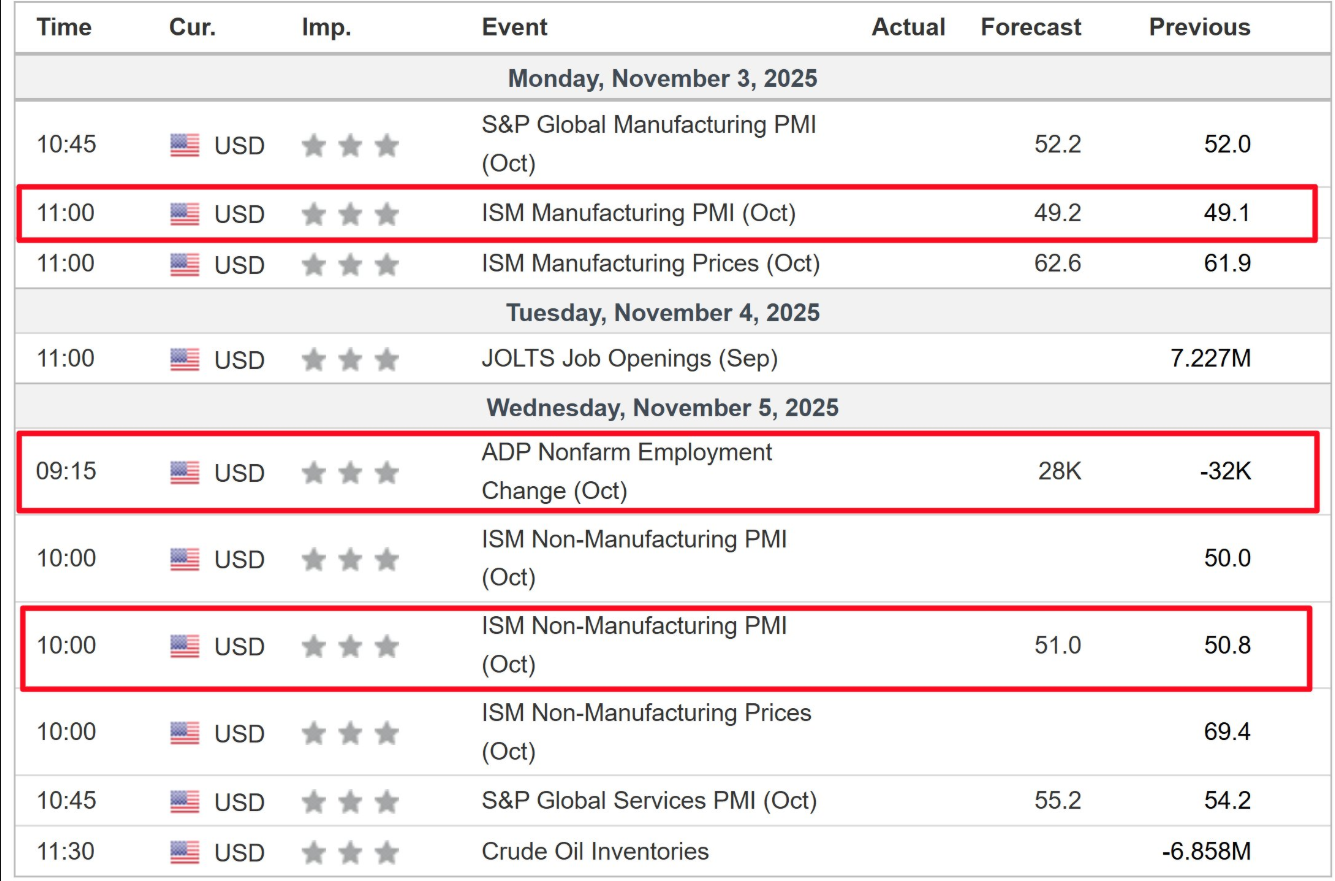

-- If a vote to reopen the Government does occur later this week, then we should expect Government Economic Data releases to resume, but even in the absence of "official data," there are several private Economic releases that could move markets:

-- The BIG focus this week will be on EARNINGS (see Calendar), starting this evening with PLTR and HIMS (two familiar names to MPTraders)... Continued below the Calendar...

PLTR-- My attached 4-Hour Chart setup shows PLTR is up 2.6% to a new ATH at 205.94 (so far) in pre-market trading ahead of Earnings. Technically, my near and intermediate-term setups argue for upside continuation to my next optimal target window of 223 to 228, with a blow-off positive reaction projected into the 240-245 area.

If PLTR reacts negatively to Earnings, heavy consequential support resides from 184.00 down to 169.50, which MUST contain and reverse the weakness to preserve the post-April 2025 uptrend, and to avert triggering a significant downside reversal signal in my work that will point to the 135-140 area during the upcoming days and weeks...

For now, heading into Earnings, the bulls are in directional control in PLTR... Last is 205.75... Continued below the PLTR chart analysis...

As for ES, my attached Big Picture work argues that as long as any forthcoming weakness is contained above or within consequential support lodged between 6780 and 6860, the dominant near and intermediate-term trends will remain bullish, and the bulls will be in directional price control, eyeing a retest of last week's October ATH at 6953.75, en route to 7000-7020 next...

Last week's downside volatility managed to press ES into the unfilled up-gap area left behind on 10/27/25 (6828-6865), from where the index has recovered to 6880-6900 to start this week and the new "seasonally improved" month of November... last is 6888.00...

Next Up: HIMS setup ahead of Earnings...