Big-Picture Setups in ES & 10-Year Yield

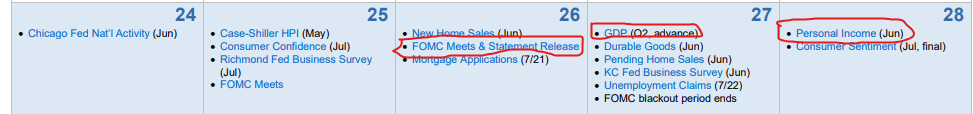

Good Monday Morning, MPTraders! July 24, 2023-- Pre-Market Update: Ahead of us this week is the reaction to Earnings, the Fed Meeting, the first estimate of Q2 GDP, and the PCE Inflation Data!

From the perspective of the markets, for starters today, let's get our bearings from my Big Picture setups for ES and for 10-year YIELD...

My attached Daily Chart of ES shows the dominant uptrends off of the major corrective October 2022 low at 3611.75, renewed at the early-March low at 3883.25 that has climbed and climbed and climbed even more to last week's high (7/19/23) high at 4609.25 (+28% from the October low). The $64,000 question is whether or not the "extended" upmove is well, overextended?

I am reluctant to go there because the answer is (obviously)"yes," but the fact of the matter remains that from a strictly technical perspective-- in my world-- unless and until enough weakness emerges that inflicts damage to the uptrend, the bulls will remain in directional control.

The small gray-shaded box on my attached Daily Chart demarcates key "uptrend support" from 4528 down to 4500, which includes the sharply up-sloping 20 DMA and the portion of the larger advance from the NVDA Earnings Pivot Low at 4158 on 5/24/23. As long as the gray box contains weakness, my pattern work cannot rule out another upmove to 4640/60 next.

Whether or not any of the forthcoming key earnings reports, FOMC decision, Powell press conference, or inflation data become THE catalyst for directional change remains to be seen. For now, the bulls are in control ... Last is 4570...

As for 10-year YIELD, investors and traders enter Fed Week with YIELD perched just above powerful support lodged from 3.75% to 3.60%. As long as any forthcoming YIELD weakness is contained above or within the support zone, benchmark longer-term interest rates will be accented higher regardless of what the Fed says or does... Last is 3.81%...