Bond Market Anticipating Weaker Economic Data

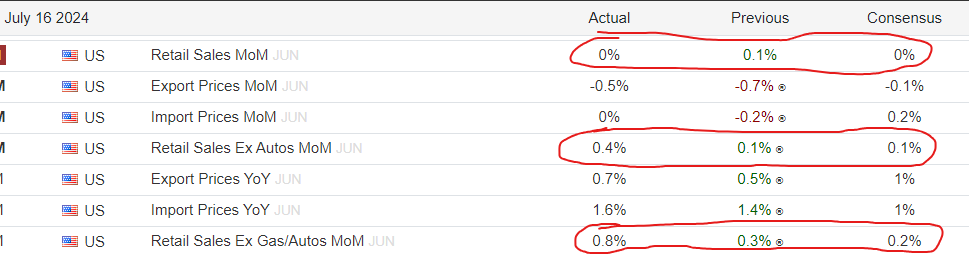

TLT and Retail Sales follow-up: Well then, remove autos and gasoline from the equation, and what we see as the residual is stronger-than-expected retail sales (see the table below)...

Although that is the case, TLT did not implode or otherwise weaken beneath key support levels in reaction to the data. In fact, just before the data were released, TLT was circling 93.58/63, and now, more than 30 minutes later, TLT is circling 93.35/40, still up 0.5% in pre-market trading.

My attached 4-Hour Chart shows that from a near-term technical perspective, as long as support at 92.50 contains any forthcoming weakness, TLT remains poised for upside continuation that challenges important resistance lodged between 94.15 and 94.85...

Is the bond market just stubborn? Or does it expect weaker economic data sooner than later? As long as 92.50 remains viable near-term support in the TLT, my bias is tilted toward the latter scenario: Mr. Bond Market is anticipating weaker economic data... Last is 93.44