Bulls Attempting to Wrestle Market Direction Away From Bears

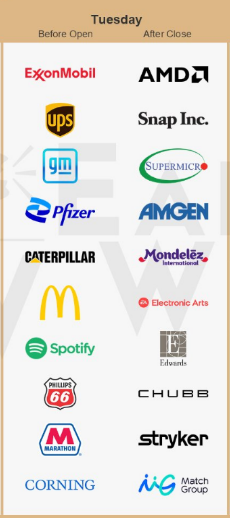

Good Morning Again, Mptraders! Tuesday, January 31, 2023-- Pre-Market Update: Today is the final trading day of January, the day before the FOMC Rate Hike Decision and Policy Statement, and a session full of some heavy-duty corporate earnings reports that will provide additional "on the ground" evidence of the health of and outlook for the US economy (see Calendar below)...

As for ES, in overnight trading, it extended its weakness off of last Friday's recovery rally high at 4109.25 into today's early AM low at 4007.50 (-2.5%) but has since pivoted off of 4007.50 into positive territory at 4040/42, mostly in reaction to a moderation in the Employment Cost Index (8:30 AM ET), which traders believe represents another data point that shows very restrictive Fed interest rate policy IS working-- raising expectations that Powell & Company will ease off on the rate hike brake pedal tomorrow.

Technically, this AM's recovery rally from 4007 to 4044 has smacked into key nearest resistance lodged from 4040 through 4052 (see my attached Hourly Chart), which MUST BE HURDLED to confirm that the correction from 4109.25 is exhausted and that the larger rangebound setup discussed yesterday (4110 to 4010) remains largely intact heading into Fed Day tomorrow.

If 4040-4052 is hurdled, we cannot rule out another run at the top of the range at 4100 to 4110.

Conversely, the inability of ES to hurdle and sustain above 4040-4052 will leave the index vulnerable to another loop down to probe the lower boundary zone of the range at 4020 to 4000.

At the moment, the bulls are attempting to wrestle market direction away from the bears... Last is 4040.50...