Disney's Acutely Negative Reaction To Earnings

Wednesday, November 9, 2022--Mptrader Pre-Market Update: The electorate has spoken, and from 30,000 feet, it appears that after two years of single-party rule, now "we" want some checks and balances in the form of gridlock-- a Republican majority in the House, a 50-50 Senate (?), and Democratic Executive Branch until 2024.

As for the markets, let's review the situation that has developed in DIS after the company reported disappointing earnings last evening...

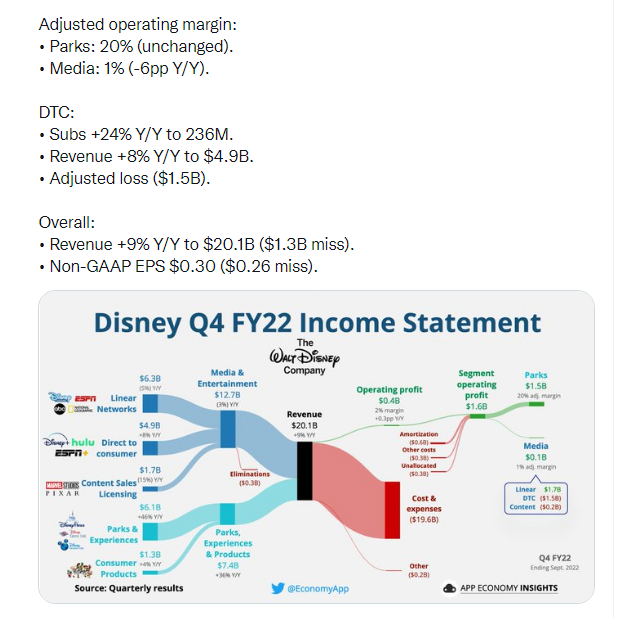

My attached 4 Hour DIS Chart shows the acutely negative reaction to earnings (see my chart and earnings graphic below) and down-spike from yest's close at 99.90 to a post-report low at 89.00, which we see violated ALL of the prior pivot lows in the low-90's for the last 5 months, AND LEAVES DIS VULNERABLE TO A PRESS THAT APPROACHES AND POSSIBLY TESTS THE MARCH 2020 PANDEMIC LOW AT 79.07.

From a more granular perspective, my preferred scenario argues that any strength in DIS will be capped beneath 98-100 resistance, which will preserve the most recent bearish setup off of the 11/01 recovery rally high at 108.84, as well as the bearish pattern that projects into lower-multi-year lows beneath 89.00, closer to the Pandemic Low-Zone of 79-81... Last is 92.40...