Downward Pressure On Yield As Dollar Hits 27-Month Low

Good Thursday Morning, MPTraders! June 26, 2025-- Pre-Market Update: Including today, there are three trading days remaining in June, Q1, and H1, 2025 (Bullish "Window-Dressing" and of End Period Mark-Ups already in progress?)... Economic Data Today: Durable Goods... GDP Q1 (Final Estimate), 2025... Weekly Jobless Claims... Pending Home Sales... Fed Head speeches from Daly, Barkin, Barr, and Hammack... White House Presser (1 PM ET)... Trump presser (4 PM ET)... NKE Earnings after the close...

First up this AM, amid a +0.4% pre-market gain in the equity futures indices, let's take a look at the reaction of interest rates to a slew of economic data overlaid by Fed Head comments from Daily, Barkin, and Goosbee, and intensifying pressure from POTUS on Chair Powell to lower rates:

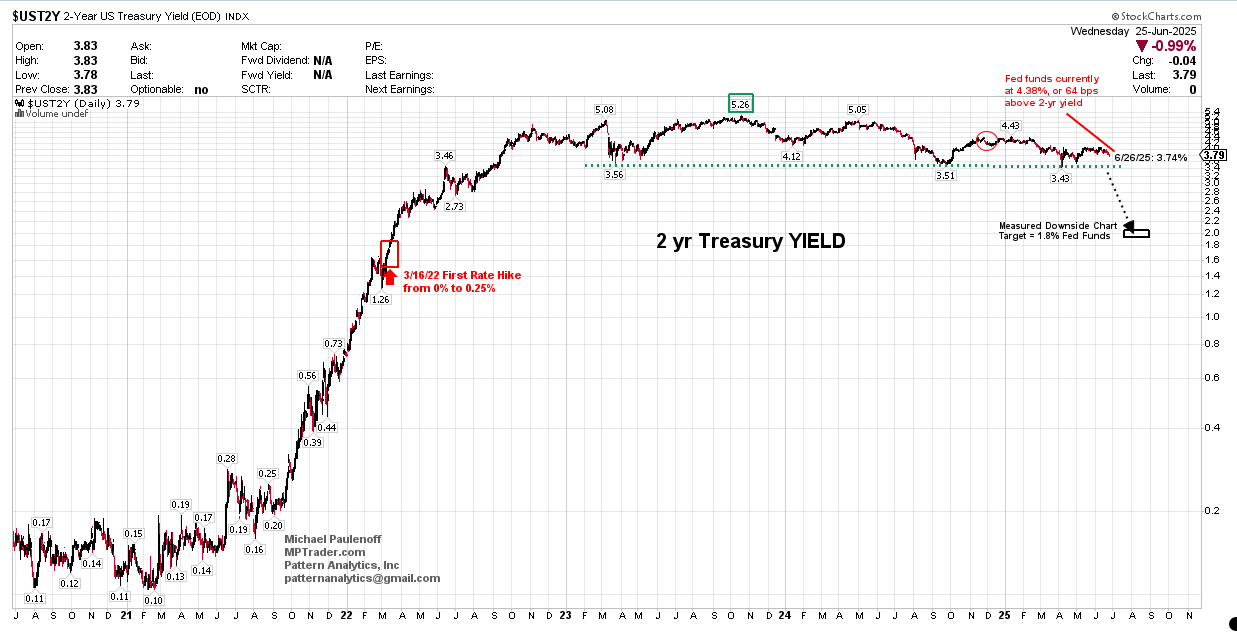

My attached chart of 2-year YIELD shows a decline from 3.79% to 3.74%, leaving it a full 64 bps below the Fed's official Fed funds rate (at least two 25 bps cuts), while my attached benchmark 10-year YIELD chart shows downside continuation to this AM's low at 4.26% (now at 4.27%).

In other words, the entire YIELD Curve is shifting downward on both the short and long ends in anticipation of lower rates.

Meanwhile, the Dollar Index (DXY chart below) shows that the Greenback has stair-stepped to the downside to a new 27-month low at 97.00, corroborating downward pressure in YIELD...

What exactly YIELD and Dollar weakness are telling us about economic growth (declining?), inflationary pressure (shifting to disinflation despite the tariffs?), and the ability of Fed Chair Powell to endure POTUS' pressure to cut rates (removal this summer?) is all up for debate... BUT, something is going on!

Back in a few minutes with my equity and stock setups... MJP