ES In High-Level Bullish Digestion Period

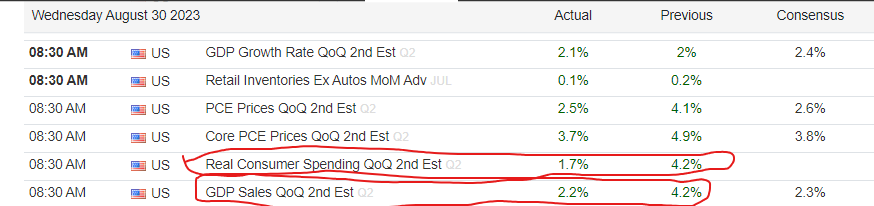

GDP Data... Consumption and Prices weaker-than-expected, which dovetails with the cooler-than-expected JOLTS data reported yesterday... Tomorrow we Powell's "favorite" inflation gauge on PCE (Personal Consumption Expenditures)...

As for ES, it popped a bit higher in reaction to GDP, into the 4514 area but remains rangebound between 4596 and 4516 atop yesterday's vertical assault from 4434, which at the moment, represents a high-level bullish digestion period ahead of upside continuation UNLESS a bout of weakness emerges that presses ES down through the now flattening 20 DMA at 4460... last is 4509.00...

Let's keep in mind that Friday morning we get the August Employment Report ahead of the three day Labor Day Holiday weekend, so trading volatility could be somewhat muted for the next 24 hours...