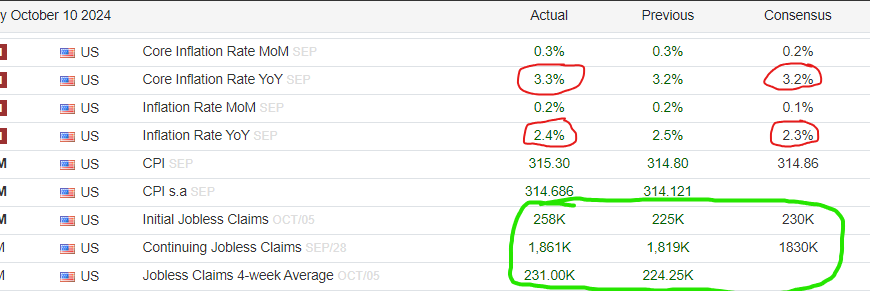

Equity & Bond Markets Cool After CPI and Weekly Jobs Data

After slightly warmer-than expected CPI data and noticeably cooler-than-expected Weekly Jobs data, the stock and bond markets will battle it out about which "macro signal" matters more-- at least during the upcoming hours.

Technically, for ES to continue to ignore all negative news, it needs to recover and sustain above 5830, which will keep the bulls in the directional driver's seat, poised for a run at 5880-5900. Conversely, a sustained break below 5815/20 will point ES lower to test 5780 to 5800, which if violated will trigger near-term downside reversal signals in my pattern work...

As for TLT, so far it has held its multi-month up trendline at 93.90 after piercing beneath it (93.70) momentarily after this AM's economic data. However, to regain upside traction and to trigger a recovery rally that indicates that at current levels the bond market (TLT) is more concerned with weakness in the labor market than a resurgence of inflation, TLT needs to hurdle and sustain above 94.25.

Conversely, the inability of TLT to climb above 94.25 followed by decline that breaks and closes beneath 93.90 will leave it vulnerable to downside continuation (higher benchmark YIELD) that will argue the bond market IS concerned about a resurgence of inflation... Last is 94.11...