Equity Indices Higher As Dust Settles After FOMC Statement

Good Thursday Morning, MPTraders! September 18, 2025-- Pre-Market Update: As we discussed yesterday afternoon, when the dust settles after the index somersaults post-FOMC statement, and post-Powell commentary, we will see the "true" market direction, which we see is UP this AM. ES is up 0.8% and has climbed to a new ATH of 6719.75, at the upper boundary of my next higher Target Zone of 6700-6720.

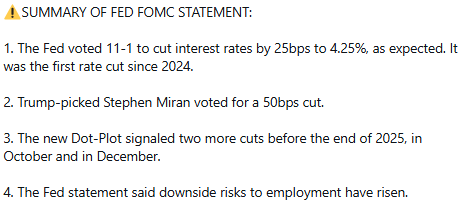

We have a Dovish-tilted Fed into year-end 2025. The equity markets are in the process of discounting another 50 bps of rate cuts by the end of December, but the fixed income markets might also start to discount stronger economic growth derived from the BBB. What then for the equity markets?

Technically, for the time being, yesterday's post-FOMC low in ES at 6611.00 is THE CRITICAL PIVOT PRICE AND THE-BULL vs. BEAR LINE-IN-THE-SAND FOR the post-April Bull Trend. As long as 6611 remains viable support, the bulls will be in directional control, eyeing a next higher target window of 6750/60 (see my attached 4-Hour Chart)... Last is 6705.50 off of a new ATH at 6719.75...