Eye On ES and AMZN (One of Our Favorite Technical Setups Heading Into 2024)

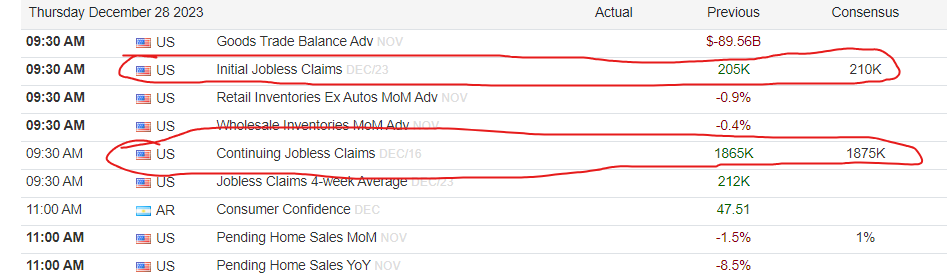

Good Thursday Morning, MPTraders! December 28, 2023-- Pre-Market Update: This morning, we get the last tranche of economic data for 2023 that could trigger a directional move in the equity and bond markets (see the Data Table below). In the event Jobless Claims ratchet up or down more than expected, an algo knee-jerk reaction is likely (the algos are never on vacation). My sense is that if there IS a surprise from the Weekly Claims data, it will show a climb in the number of people who are applying for unemployment insurance in a sign that the labor market is (finally) softening, which will fit right into Wall Street's dominant narrative these days: A soft landing is in progress (whether we believe it or not!)... (continued below the data table)...

My attached 15 Minute Chart of ES shows the stair-step rally pattern in the aftermath of the 12/20 downside air pocket (4830 to 4743). ES has since climbed to a new Oct-Dec 2023 high at 4841.50 as it closes in on my next immediate target zone of 4850/60, and thereafter, possibly closer to 4900.

As long as any forthcoming weakness is contained above or within nearest support from 4816.50 to 4811, the bulls will remain in directional control.

However, should ES press beneath 4811, the post-12/20 pattern setup will weaken and leave ES vulnerable to downside continuation to 4783/85 initially, and if violated, then to 4750... Last is 4833.50... (Continued below the ES Chart)...

AMZN is one of my "favorite" technical setups heading into 2024 despite the fact that it has climbed 32% from its Oct. 2023 low at 118.23 to the 12/20/23 high at 155.63. My attached 4-Hour and Daily charts exhibit very bullish pattern structures that argue as long as any acute forthcoming weakness is contained above 140 in the days and weeks ahead, AMZN's technical setup projects considerably higher to 161-165 next, in route to a 180-185 and possibly 200 thereafter during the first half of 2024... Last is 153.84...