Eye On ES and YIELD After PPI Release

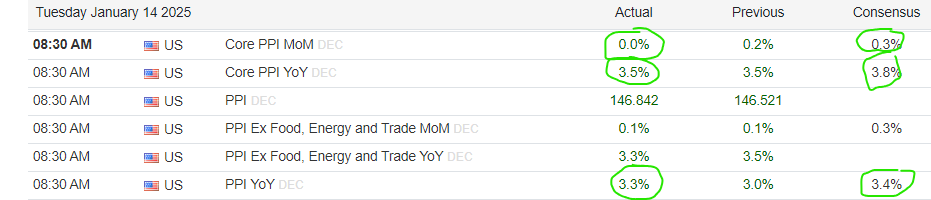

The PPI data came in cooler-than-expected (see data table below), which popped ES futures from 5877.75 to 5918.50... Last is 5898.50, positioning the index above my CLOSING line-in-the-sand upside trigger level after PPI and ahead of tomorrow's (arguably) more consequential CPI data...

For its part, 10-year YIELD is unchanged at 4.79% after the cooler PPI data, which does not give me (or the equity indices) a warm and fuzzy feeling but likely means that the focus for the bond market is on tomorrow's CPI, not PPI...

For today's session, as long as ES remains above 5882, the next key resistance zone is 5925 to 5950, which we see on my attached Hourly Chart represents a test of the Weekly Pivot (5951).