Eye On Fed, Plus Bullish Seasonal Outlook for ES

Good Thursday Morning, MPTraders! November 13, 2025-- Pre-Market Update:

-- The Government is up and running again, but who knows when to expect "official economic data" to be released for October, if ever? Hopefully, Jay Powell and the FOMC can otherwise arrive at a reasonable conclusion about the health of the economy, the labor market, and inflationary pressures before the December 10th Fed Meeting...

-- With the foregoing in mind, there are several Fed Heads scheduled to give speeches today: Daly, Kashkari, Musalem, and Hammack... Will there be a unified message in what they tell us?

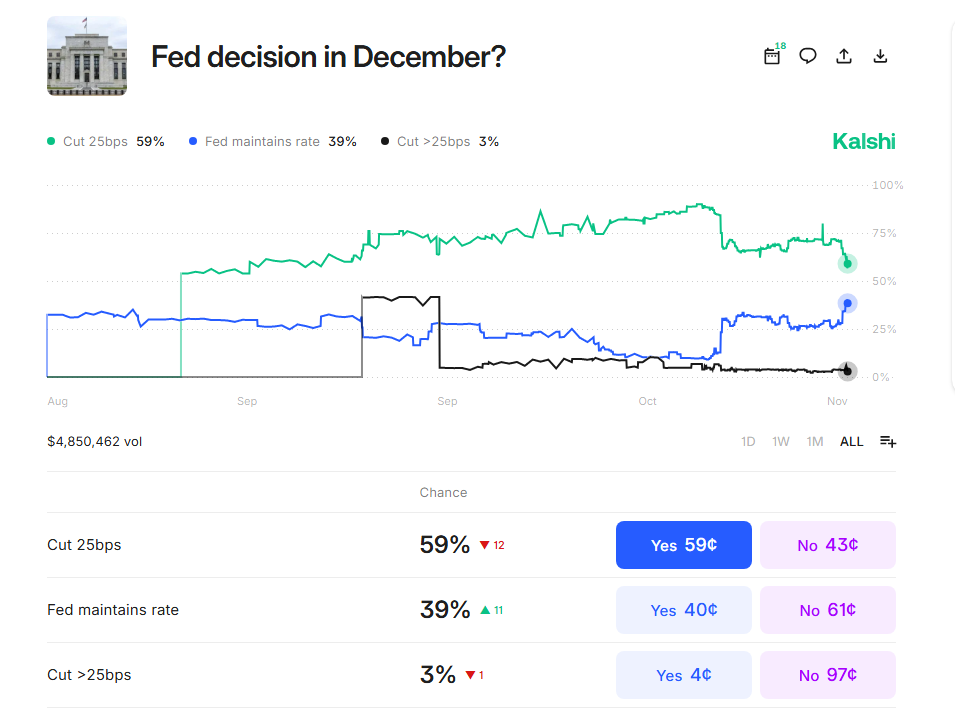

-- As of a few minutes ago, Kalshi Betting shows a 59% expectation of a 25 bps rate cut on 12/10/25...

-- As for Seasonality, this is what happens much more often than not this time of year: Will 2025 follow the seasonal script, or be an outlier?

The Markets: ES-- Given the squishy price action during the last several hours of trading, the weakness indicates that the upleg from last Friday's low at 6655.50 to yest's high at 6900.50 is complete, and that the index is in the grasp of a pullback that will retrace some percentage of the 245-point advance

Initial key support is from 6825 to 6845, wherein resides the sharply upsloping 20 DMA (see my Big Picture Daily chart attached below). A test of the 20 DMA will represent a retracement of 30% of the entire post-11/07 upleg.

If ES breaks and sustains beneath the 20 DMA (6827), then ES will be vulnerable to a much deeper retracement of the 11/07-11/12 upleg that my work argues points to the 6750/70 Support Target Window (See my attached Hourly Chart below)...

My primary scenario argues for ES to pivot to the upside into another powerful advance once this pullback is exhausted... Last is 6846 off a pre-market intraday lo at 6841.50...