Eye On Yield Ahead Of Tomorrow's Fed Rate Decision

Good Tuesday Morning, MPTraders! December 9, 2025-- Pre-Market Update:

-- Today is the 236th trading day of 2025... 15 trading days remain after today into year-end, which is not much time for the underperforming equity managers...

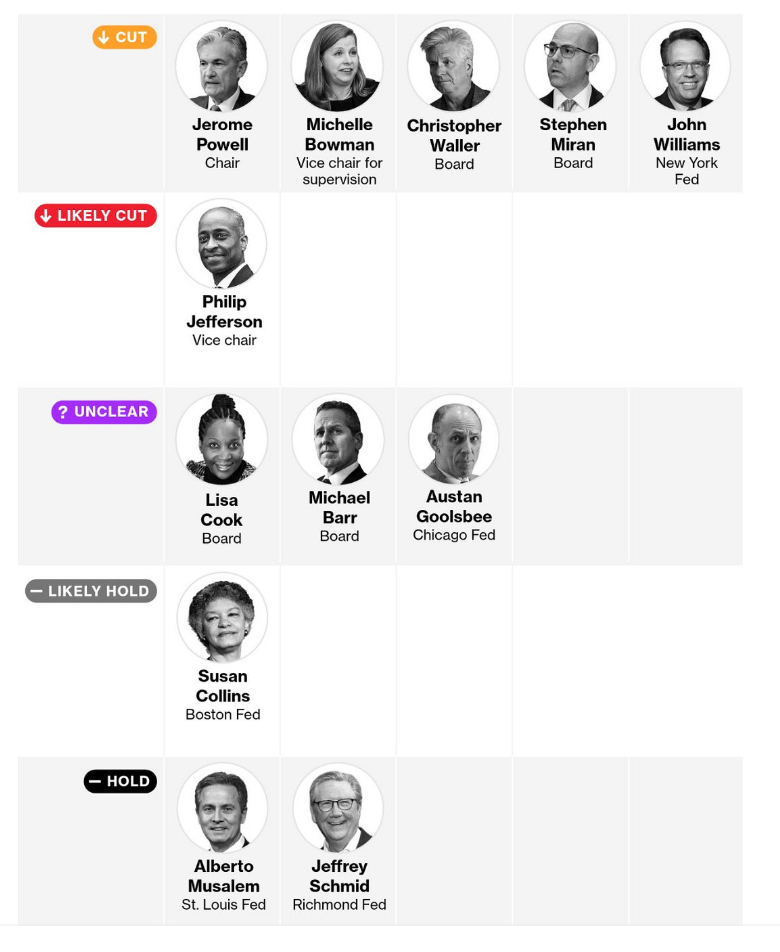

-- Tomorrow we get the FOMC policy decision, statement, and Powell press conference... According to the Kalshi betting market, the odds of a rate cut are at a historical high at 94%... BUT, according to the latest CNBC Survey, only 45% think the Fed should cut!...

-- Today and tomorrow's trading activity should be muted with a negative technical bias ahead of decision time tomorrow afternoon at 2 PM ET...

My attached Hourly ES chart indicates that the minor pullback from last Friday's (12/05/25) high at 6905.00 to yesterday's (12/08/25) low at 6835.25 (-1%) indicates that unless ES rallies and sustains above 6880, the pullback will extend into the 6790 to 6810 support window...

From a Big Picture perspective, my attached Daily chart shows downward pressure on the up-sloping 8 Day EMA, now at 6843, which, if (when?) violated, will trigger a press toward a test of the 20 DMA, now at 6780 (suggesting that my Hourly and Daily charts are in agreement about downside extension IF yesterday's low at 6835.25 is violated and sustained)...

Lastly, 10-year YIELD has carved out an "interesting" if not disturbing pattern on the longer end of the Yield Curve. For the past 2-1/2 months, YIELD has formed an inverse Head & Shoulders pattern that hints that a surge in YIELD to a minimum target of 4.33% and an optimal target of 4.45% is approaching rapidly.

That said, however, as long as the resistance Neckline of the pattern at 4.17% to 4.20% keeps a lid on upside continuation, YIELD will remain capped and within the multi-month range from 4.00% to 4.20%...

From a more granular perspective, a sustained press beneath 4.10% will neutralize the upward pressure toward a 4.20% breakout thrust into a new upleg.

Considering the FOMC will make a significant rate decision and issue a meaningful policy statement on Wednesday afternoon, we should be acutely aware of the reaction of Benchmark 10-year YIELD... Last is 4.15%...

(From Market Mahem Twitter Account)