Eye On Yield Ahead of Economic Data Releases

Good Thursday Morning, MPTraders! April 10, 2025-- Pre-Market Update: Benchmark 10-year YIELD is circling 4.30% as we speak, down from yesterday's tariff-induced "something is breaking in the financial system" spike high at 4.53%, from yesterday's close of 4.40%, and just ahead of this AM's economic data on CPI (March) and Weekly Jobless Claims, suggesting that the bond market has course-corrected and returned to Treasury Secretary Bessent's scenario calling for much lower benchmark 10-year YIELD (see my attached Chart)...

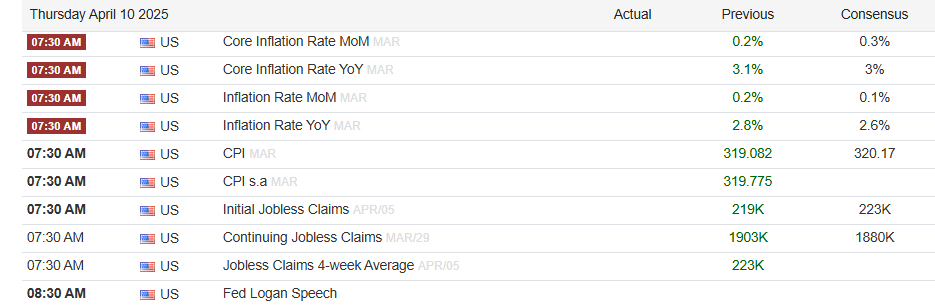

I suspect that the bond market is minimally concerned about a hotter-than-expected surprise in either CPI or Weekly Jobless Claims, and as such, expectations for an outlier are probably tilted toward in-line or cooler-than-expected data points... (continued below the Data Table)...

(From TradingEconomics... Release times do not reflect Daylight Savings Time)...

As we speak, YIELD weakness has pressed beneath the dominant near-term up trendline off of last Friday's low at 3.89% that cuts across the yield axis at 4.33%. Let's see if this AM's economic data presses YIELD further below the week-long up-trendline into a test of near-term support from 4.27% down to 4.22%... (continued below the YIELD Chart)...

As for ES this AM, although in absolute terms the index is down 90 points and 1.6% in pre-market trading, the weakness at its overnight low at 5359.50 amounted to a very shallow 26% retracement of the 657 point upleg from yesterday's low (see attached chart) to the after-market peak. Purely from a technical setup perspective, as long as any additional weakness is contained within or above the 5170-5350 support window, my pattern work argues for another upleg off of the Friday-Wednesday Double Bottom (W) formation that has a measured upside projection of 5720/50.

That said however, my next optimal upside target window is 5575 to 5600, which is the next higher objective from where I am expecting ES to roll over into a much deeper bout of weakness... Last is 5386.25...