JPM Tops Estimates, NVDA Pops On Eased Chip Trade Restrictions

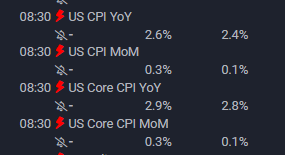

Good Tuesday Morning, MPTraders! July 15, 2025: Pre-Market Update: JPM beats but reacts sluggishly so far, NVDA pops 4.5% as Trump Administration enables chip exports to China, and ES spikes to a new ATH in reaction to the chip news, ahead of this AM's CPI Report (see expectations below)...

(FinancialJuice)

JPM beat The Street's estimates on Earnings and Revenue, and raised guidance for fiscal year 2025 net interest income. In reaction to the good news, JPM initially spiked to 295.00 from Monday's close at 288.70 (+2.2%), but has relinquished the gains. As we speak, JPM is trading at 285.70. My attached 4-Hour Chart indicates that unless and until weakness breaks and sustains below 280, JPM bulls will give the dominant post-April uptrend the benefit of the doubt for upside continuation to take out the 7/03/25 ATH at 296.40... (continued below the JPM chart)...

NVDA popped nearly 5% in response to news that the Administration will allow the company to export its H20 chip to China. My attached Big Picture Daily Chart shows that today's up-gap thrust has taken out key resistance at 161 to 164, which triggers a higher target zone of 175-180 (discussed in my July 8, 2025 update). With this AM's upmove, my refined target window is 180 to 182. Only a total retracement of today's upmove and a close below 164 will compromise the bullish setup ... Last is 171.32... (continued below my NVDA Chart)...

As for ES heading into this AM's CPI report (8:30 AM ET), as long as the CORE Y-o-Y data come in at 2.9% or below, the June inflation news should be a non-event. Key near-term support resides from 6260 down to 6225. As long as it remains intact, the bulls will remain in directional control eyeing 6360/70 and 6400-6420 as their next upside target zones... Last is 6327.75 (see my Hourly ES chart below)...

More after the CPI data...