Lots of Anticipation Heading into This AM's April CPI Report

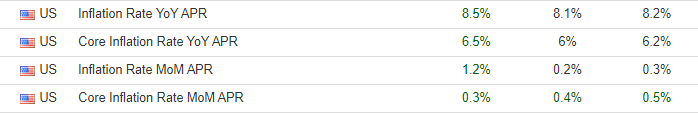

Wednesday, May 11, 2022-- Mptrader Out Front: CPI Data due out at 8:30 AM ET (see The Street's expectations below)...

It appears just about everyone is waiting for a sign of moderating or "peak" inflation for an "all-clear" sign that it is "safe" for the bulls to wade back into the turbulent waters of the equity markets.

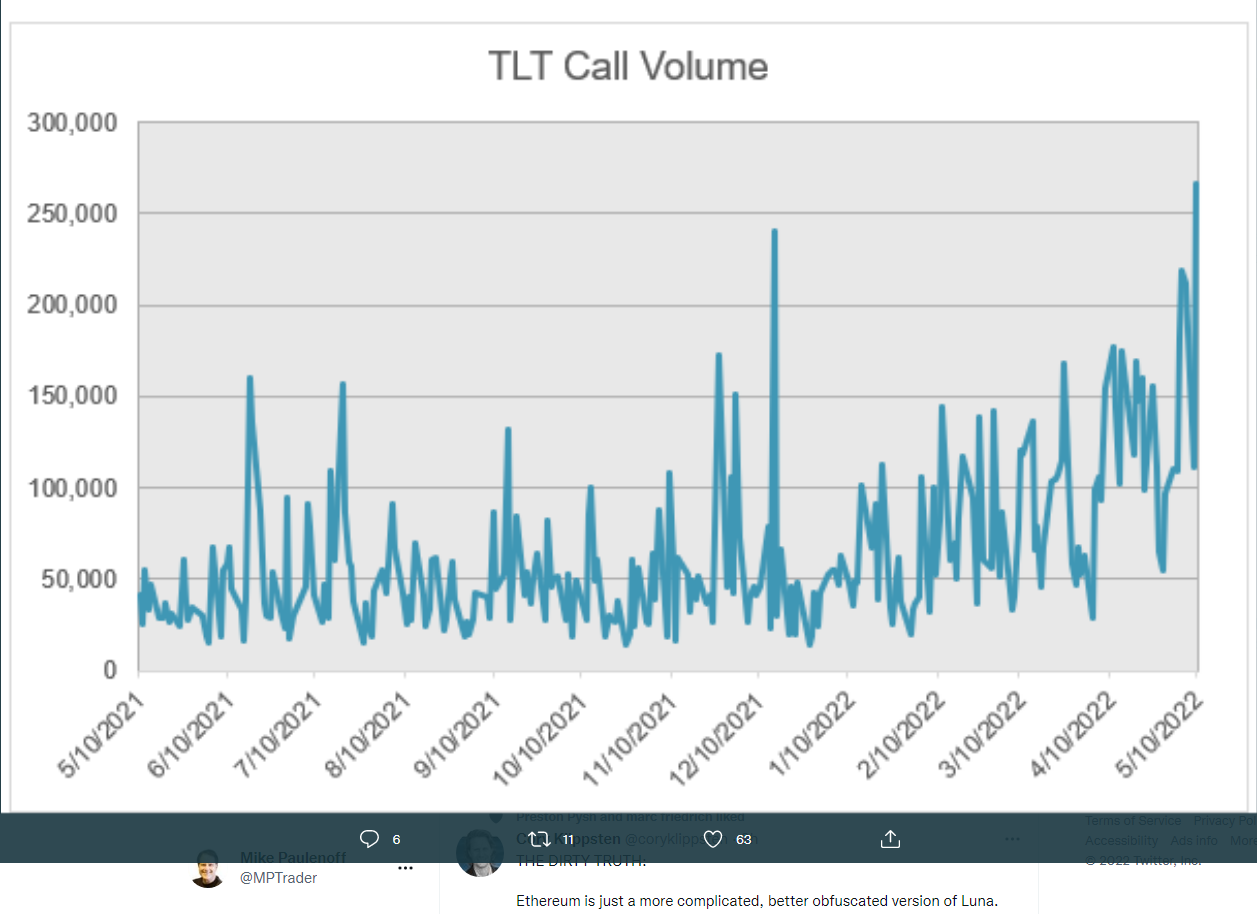

Is that right? Can it be that simple and straightforward? Maybe. The graphic below shows that bond traders are definitely skewed to the buy-side in the TLTs (20+ year T-bond ETF) heading into this AM's price data. Indeed, my attached TLT Chart shows that since Monday's multi-year low, TLT has climbed 4.2% into this AM's pre-market in anticipation of price data that support continued recovery strength (and a correction in YIELD). Technically, TLT needs to continue higher, challenge, hurdle, and close above 118.60/80 resistance to inflict damage to the dominant downtrend pattern and to regain significant upside momentum.

As for ES, the initial upmove from yesterday's new corrective low at 3953.00 to the overnight high at 4043.75 exhibits bullish form, and will continue to do so unless a bout of weakness nosedive the index beneath 3953, in which case my pattern work will trigger a new downside target of 3840/50.

Barring a sharp decline from a presumably disappointing (higher than expected) CPI Report, ES has the right look of a budding, potentially powerful recovery rally. If yest.'s rally high at 4065.50 is taken out, ES will point to 4110-4120 next, in route to a challenge of the Weekly Pivot at 4155.

To inflict serious damage to the dominant downtrend, ES needs to climb and close above 4215, a level that resides 4.3% above the current price of 4040.00...

Previous Consensus Tradingeconomics Forecast