Market Coiling Ahead of a Bullish or Bearish Catalyst

Good Thursday Morning, MPTraders! February 19, 2026-- Pre-Market Update:

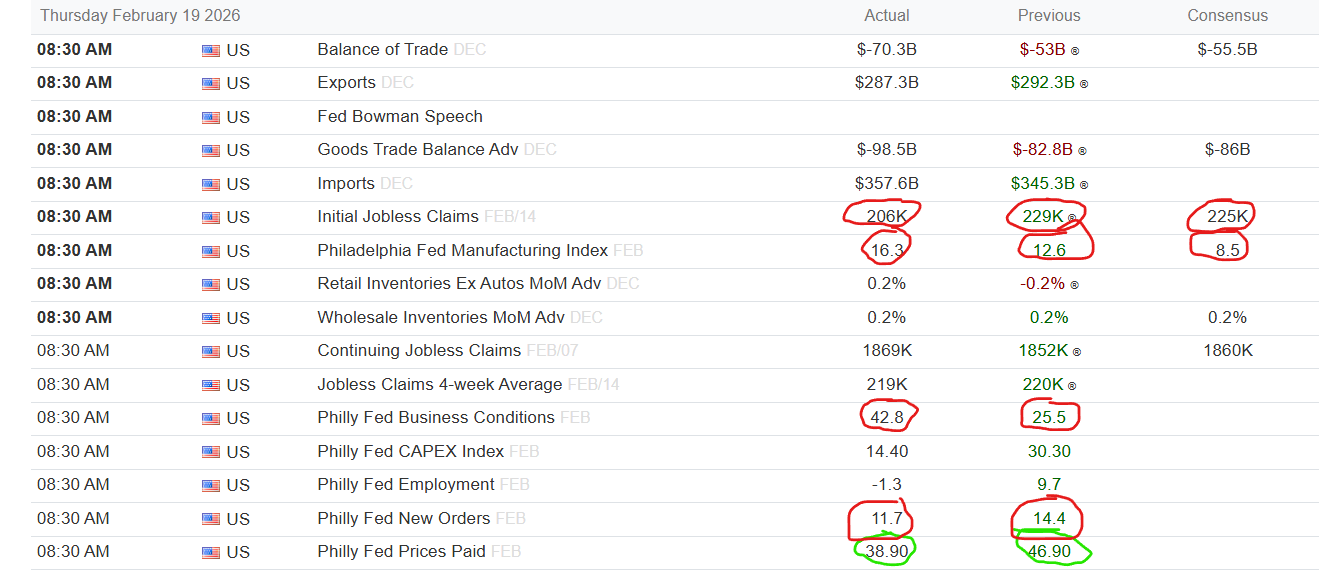

Economic Data Today: For the most part, stronger Labor data than expected, stronger Manufacturing Data than expected, stronger Business Conditions and Manufacturing Orders than expected, overlaid on declining inflation... all of which-- to the extent that we believe this round of data-- to this observer, seems Goldilocks-ish, no? (Continued below)...

Goldilocks or not, this "miserably" range-bound circle jerk of a market is what we encounter every day. It is as if the market is frustrating itself into a flatline EKG, ahead of a frantic directional breakout frenzy in one direction or other. Such a scenario suggests the market is coiling ahead of a bullish or bearish catalyst that provides the next directional surge. Perhaps this week's PCE Inflation Report (Friday), or the potential for SCOTUS to render its decision on the constitutionality of the Trump tariffs, or any day now, news that the U.S. and Iran are at war, or have arrived at a diplomatic solution to their standoff?

What are the technicals telling me about the pattern situation?

-- As long as ES is trading below its 20 DMA (6935), the bears are in nearest-term directional control...

--- The 5-day contracting range is 6935 down to 6820, which resides within a larger multi-month range of roughly 200 points, between 6800 and 7000...

-- The latter half of February historically exhibits a negative price seasonal pattern for SPX (see below)...

For today, ES needs to preserve support from 6820 to 6800 to thwart any intraday "bear attack," while any strength needs to challenge and take out resistance from 6925 to 6935 for the bulls to regain potentially significant upside traction... last is 6868.25...