Market Reaction To CPI

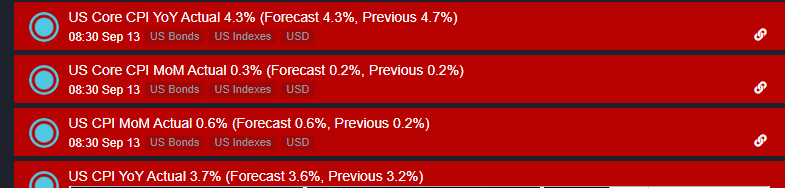

CPI (August)-- Net net, the inflation data came in a touch hotter than expected (see Headlines below), which initially triggered an algo knee-jerk ES down-spike from 4513 to 4495, but was followed nearly as quickly by a recovery to 4510/14, where the index is circling now. As we discussed earlier, if the data are not way out of line, then after the initial reaction, the technical condition of the market will become the main influence on intraday price action.

My attached Hourly Chart of ES shows the series of higher-lows that have been established since 8/18 (4399.50... 4414.75 on 8/25... 4484.25 on 9/07... 4495 today). As long as any forthcoming weakness is contained above the two most recent entries at 4495 and 4484.25, my nearest-term setup work argues that ES remains rangebound roughly between 4485-4495 on the low side and 4532 (trendline resistance) to 4549 (50 DMA) on the high side.

For the time being, the fact that the knee-jerk down-spike in reaction to CPI held nearest support at 4485 followed by a recovery into marginally positive territory indicates that ES will spend the next couple of hours attempting to challenge the upper boundary zone of the above-mentioned range (4532 to 4549)... ZZZzzzzzz.... perhaps until tomorrow's PPI and Retail Sales data, followed by Friday's September Option Expiration... Last is 4513.50

FinancialJuice