Negative Reaction to Employment Cost Index

Good Tuesday Morning, MPTraders! April 30, 2024-- Pre-Market Update: Today is the final trading session of April, but the first day of a two-day FOMC Meeting... After the close, Big Tech earnings from AMZN, AMD, SCMI, and SBUX...

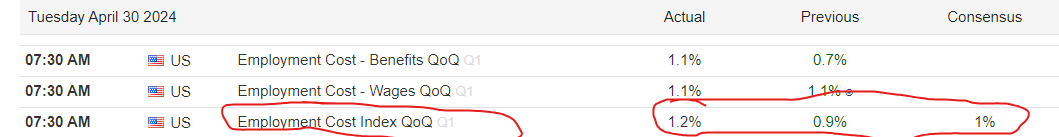

But first up is the negative reaction to the Employment Cost Index (Q1, 2024), which came in much higher than expected at 1.2% vs. 1%, and apparently has given the near-term overbought equity indices an excuse to correct some of the 3.4% upmove in SPY from 493.86 (4/19/24) to 510.75 (4/29/24).

In reaction to the data (which according to CNBC's Steve Leisman is the Fed's favorite employment-wage indicator) SPY nosedived to 507.60 from 509.93 (-0.5%), however, my attached Hourly Chart shows that the weakness has not inflicted much if any damage to the overall post-4/19/24 technical setup.

That said, downside continuation that violates yest afternoon's down-spike to 507.25 will begin to morph the most recent 3+ sessions into a top formation that will trigger a downside projection toward my lower corrective target window of 503 to 500... Last is 507.97...