No Damage Yet To Dominant Nearest-term Downtrend

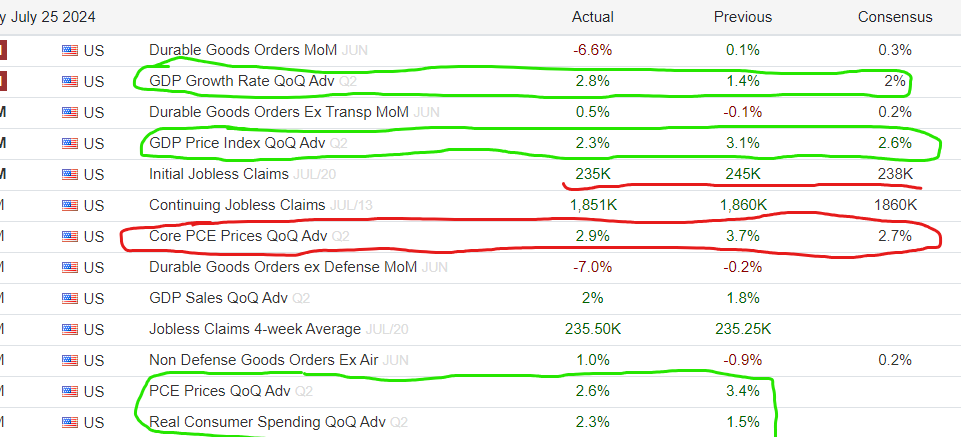

ES-- Bottom Line from this AM's mixed bag of economic data: Inflation continues to moderate while the consumer continues to spend, suggesting the "best" of both worlds perhaps, but who knows if this data moves the Fed's needle closer to a rate cut or not (probably not).

That said, tomorrow's BIGGY Inflation data point from PCE for June is MUCH more consequential to both the markets and to Jay Powell.

In the aftermath of this AM's data, ES has climbed from 5459.25 to 5473.50 or so, which we see on my attached 15 Minute Chart has not (yet?) inflicted any damage to the dominant nearest-term downtrend. To do so, ES needs to chew its way through resistance starting at 5480 that extends up through 5510. The inability to do so leaves ES vulnerable to another loop down that retests 5440/50.

At the moment, my preferred scenario argues for ES to hold in and around 5440/50 but below 5510 throughout today's session into tomorrow AM's PCE inflation report, which represents the next consequential market-moving macro catalyst... Last is 5472.00...