Positive Reaction (So Far) To BA's Otherwise Lukewarm Earnings Report

Good Wednesday Morning, MPTraders! October 25, 2023-- Pre-Market Update: The Morning After-- MSFT and GOOG Earnings... META after the Close... Another vote for Speaker... and the Fog of War... But, first up, BA (Boeing) Reported Earnings This AM...

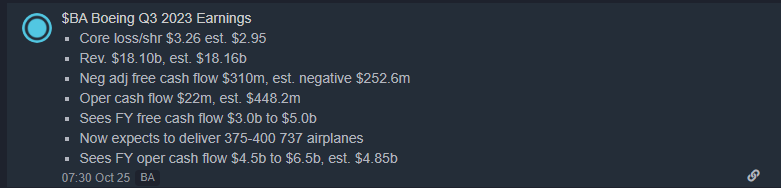

BA earnings certainly were underwhelming considering it lost more money than The Street anticipated, and because the company announced it will deliver fewer 737 Max aircraft than it expected during 2023!

That said, however, purely from a technical perspective, the reaction to the not-so-good news shows that BA stock is higher in pre-market trading so far. BA is trading at 188.50 off of yest's close at 182.36 (+3.4%). We see on my attached 4-Hour Chart that BA strength this AM is pushing up against key resistance along the August-October down trendline that cuts across the price axis in the vicinity of 189.50, and if taken out and sustained, will trigger near-term upside reversal signals, and also will point BA toward a challenge of much more consequential resistance lodged between 196.25 and 199.60.

From a bigger-picture perspective, my attached Daily Chart shows that at the October low of 178.43, BA established a glaring positive Momentum divergence, which is a warning to us that BA's relentless corrective weakness from the August 243.10 high (-27%) is at or nearly exhausted, presumably ahead of a potent recovery rally. This AM's positive reaction to an otherwise lukewarm earnings report suggests BA is in "the U-Turn" phase ahead of a recovery rally that projects into the 200-210 area... provided a resumption of weakness is contained above support at 178.50 to 181.50... last is 188.00