TLT, ES Poised For Upside Continuation

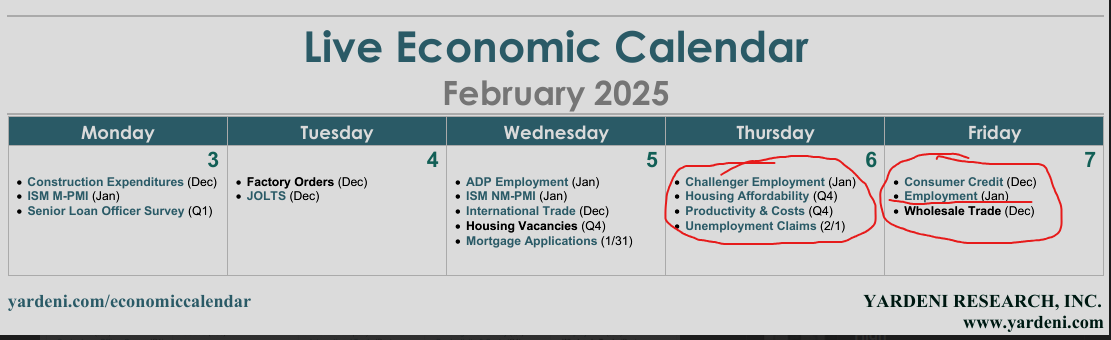

Good Thursday Morning, MPTraders! February 6, 2025-- Pre-Market Update: Today and tomorrow, traders and investors will focus on Jobs-related economic data in the next round of potentially meaningful directional market catalysts (See Economic Calendar below)...

Heading into the data releases, TLT (see my attached Daily Chart) exhibits a positive setup poised for upside continuation that thrusts above the multi-month down trendline and yesterday's high in the vicinity of 90.18, which, if hurdled, will trigger a next higher projection to 91.50-92.00... Only a sustained negative reaction to the data that presses TLT beneath support at 87.40/80 will compromise the current setup... Last in pre-market is 89.65...

As for ES, my Big Picture setup shown on the attached Daily Chart argues for upside continuation above my current target zone of 6100-6110 to challenge the January-February resistance line in the vicinity of 6130. As long as any acutely negative price action is contained above the up-sloping 20 DMA at 6036 (a 64-point, 1% differential with the current price of 6100), my pattern work will remain biased to the upside.... Last is 6099.75...