TSLA Surges On Earnings, Goosing Broader Markets

Good Thursday Morning, MPTraders! October 24, 2024-- Pre-Market Update: TSLA's Earnings came in "less bad" than expected, triggering a 14% thrust that influenced the major market equity futures indices in early AM trading (see CNBC article below my charts).

TSLA-- In my late afternoon chart analysis ahead of earnings yesterday, this is some of what we discussed in expectation of the earnings report:

Let's notice that TSLA pressed to a new corrective and 4-week low at 212.11 today, down a full 20% from its 9/30/24 summer rally peak. In so doing, TSLA also sliced beneath a significant 6-month support line in the vicinity of 215.40 as well. Considering the potential technical damage so far, TSLA has not followed through to the downside aggressively... In fact, today's low is NOT CONFIRMED by my 4-hour Momentum gauge (see my attached chart), which if nothing else, should give pause to anyone looking to bail out of TLSA before earnings are released after 4 PM ET today. Reporting earnings into a 20% decline that has preliminary evidence of downside exhaustion suggests to me that the news will have to be extremely pessimistic, especially in terms of margins and guidance, for the reaction to slam the stock price to my next optimal corrective Target Window in and around 200, which also happens to be the coordinate of the modestly down-sloping 200 DMA... Last is 213.87...

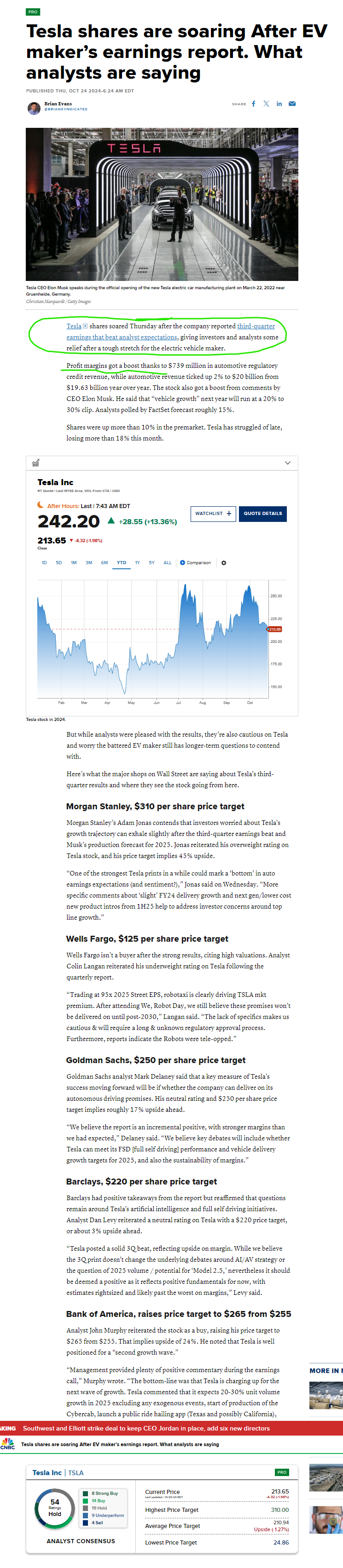

Fast-forward to this AM, we find TSLA is trading just above 243, up nearly 14% from yesterday's close at 213.65. The positive Momentum divergences sighted above provided us with clues about the probable (but never certain) directional reaction to earnings. My attached 4-Hour Chart shows the vertical up-spike that has surged above 1) 216, which represented the coordinate of the April-October support line severed yesterday morning, 2) TSLA's dominant near-term down trendline in the vicinity of 219.00, 3) initial resistance at 224-225, and 4) the 50 DMA at 228.29 as of yesterday's close, which now becomes support on any forthcoming pullback...

This upmove argues strongly that Wednesday's new, unconfirmed, corrective low at 212.11 ended the corrective decline from the 9/30/24 rally high at 264.86 (-20%), and initiated a new rally phase that projects to another test of 12-month resistance from 265 to 270... Last is 243.21...

As for the market indices this AM, the TSLA price surge has goosed the broader market as well. ES has climbed back above a key technical inflection point along the 20 DMA, now at 5835 after trading well beneath the MA yesterday (5801). Furthermore, ES is bumping up against the 8-Day EMA at 5869, which, if hurdled and sustained on a closing basis, will represent a very positive near-term technical omen that yesterday's late-session pivot off of 5801 ended a minor correction (-2.1%) off of the ATH established at 5927.25 on 10/17/24.

Conversely, an inability of ES to preserve and close above the 20 DMA later today will leave the index vulnerable to a retest of the now more consequential 5800-5810 support zone... Last in ES is 5866...

From CNBC.com