Tight Downside Breathing Room For ES

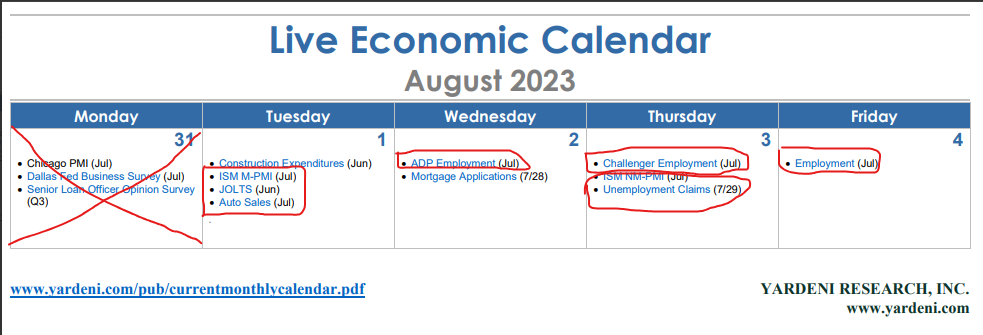

Believe it or not, it's August already! Good Tuesday Morning, MPTraders! August 1st, 2023-- Pre-Market Update: Economic Data (see Calendar below), and Earnings: UBER, JBLU, AMD, DVN to mention just a few high profile names...

As for the markets, two macro index chart setups caught my attention heading into August: ES and Crude Oil: ES is up first, and Crude Oil will follow in my second update...

Let's notice on my attached 4-Hour Chart that ES enters August perched atop its relentless nearest-term up trendline that originated at the 5/24/23 NVDA Earnings Pivot Low of 4158 to the 7/27/23 multi-month recovery high at 4623.50 (+11.2% in just three months).

The trendline currently cuts across the price axis in the vicinity of 4540, but to get down there, ES will have to slice beneath a cluster of VERY CONSEQUENTIAL SUPPORT LEVES at 1) 4598 = The Weekly Pivot Price... 2) 4564 = the new August Monthly Pivot... and 3) 4545 = the current position of the sharply up-sloping 20 DMA... For ES to press to test its dominant nearest term powerful up trendline at 4540, any preceding weakness will have to violate support lodged from 4600 (roughly) down to 4545, which will inflict serious technical damage in any case.

In other words, from my perspective at the outset of August, and in the aftermath of a three-month 11% advance, ES has "breathing room" of just 1.3% on the downside without inflicting potentially significant technical damage.

With the foregoing in mind, you can imagine that I am all for hedging portfolios if and when ES breaks 4540. Conversely, as long as 4600 to 4540 support contains any forthcoming weakness, my next optimal target zones for ES remain 4640/60 and if taken out and sustained, 4800 to 4850 thereafter... Last is 4598.50...

Crude Oil next...