Will CPI and PPI Create a Peak in YIELD, and a Buying Opportunity in the Bond Market (TLT)

Monday, April 11, 2022-- Out Front: Is the Bond Market Close to a Major Counter-Trend Rally?

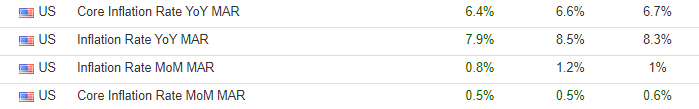

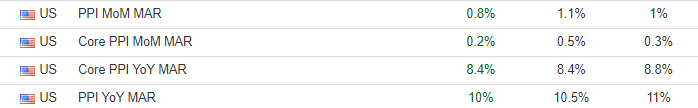

Tomorrow and Wednesday, inflation data on CPI and PPI for March will be released (see expectations table from Tradingeconomics.com below). The expectations suggest headline inflation will remain very elevated: Y-o-Y CPI-- 8.5% and PPI expected at 10.5%.

Previous Consensus Forecast

Previous Consensus Forecast

On one hand, we have persistent (not transient) inflationary pressure that finally has motivated the Fed to start tightening monetary conditions, but with 2 year YIELD at 2.5% compared with Fed funds at 0.25%, the FOMC finds itself in a situation of needing to play catch-up in a hurry... unless of course, Jay Powell and Company opt for some other scenario, such as a "One and Done" 50 bps or 75 bps hike in May?

Meanwhile, 10 year YIELD has backed up from 1.68% to 2.78% (+65%-- see my attached chart) in just the last 5 weeks (!!!), which likely is a reflection of a confluence of economic, financial, and geopolitical conditions that Mr. (bond) Market thinks is driving and will continue to drive inflationary expectations higher, and has put the Bond Vigilantes into the driver's seat for the first time in decades, and perhaps positions them to steer the Fed whether Powell & Company like it or agree with it or not. My attached Weekly benchmark 10 year YIELD Chart also shows that at 2.78%, YIELD has satisfied my initial intermediate term upside target derived off of the three year base formation at the conclusion of the 1980 to 2020 YIELD Bear Market, and as such, my work is warning me (us) that we should not be surprised to see the upmove in YIELD take a breather and pull back into the 2.40%-2.50% area in the days ahead.

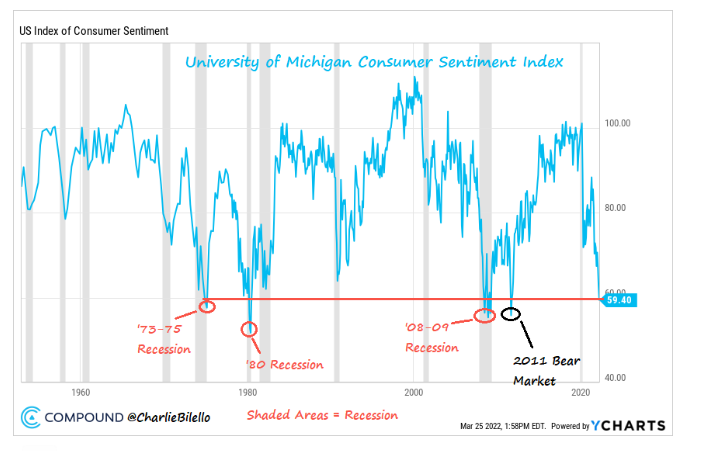

On the other hand, we have the 2s-10s YIELD Curve (see chart below) and Consumer Sentiment (see chart and comment below) Flashing Recession Warning Signals (that the bond market should be watching closely now)... TLTs are on our radar screen, looking for signs of downside exhaustion and a significant technical upside reversal, leading to an opportunistic countertrend rally period... (see my attached chart). This AM, TLT pressed to another new low at 123.40, a low price last seen in May 2019. This AM's new low has NOT (yet) been confirmed by my 4 Hour Momentum gauge, which represents a trading alert ahead of tomorrow's CPI report, and a heads-up that barring a really outrageous outlier figure for CPI, that TLT likely is about to experience the "beachball effect," when lower prices do not sustain, and instead, prices experience buoyancy in reaction to otherwise negative news. To gain initial upside traction, TLT needs to climb and close above Friday's close at 125.12... Last is 124.06...

Comment about Michigan Sentiment from Charlie Bilello, Founder & CEO of Compound Capital Advisors:

In the last 70 years, the only time US Consumer Sentiment was this low without the US being in a recession was a brief period during the 2011 bear market (Aug-Sep ’11). 32% of respondents in the University of Michigan survey said they expected their financial position to worsen in the year ahead, the highest level ever recorded (survey started in mid-1940s).