Silver Futures Hit a 14-Year New High During Today's Holiday Session!

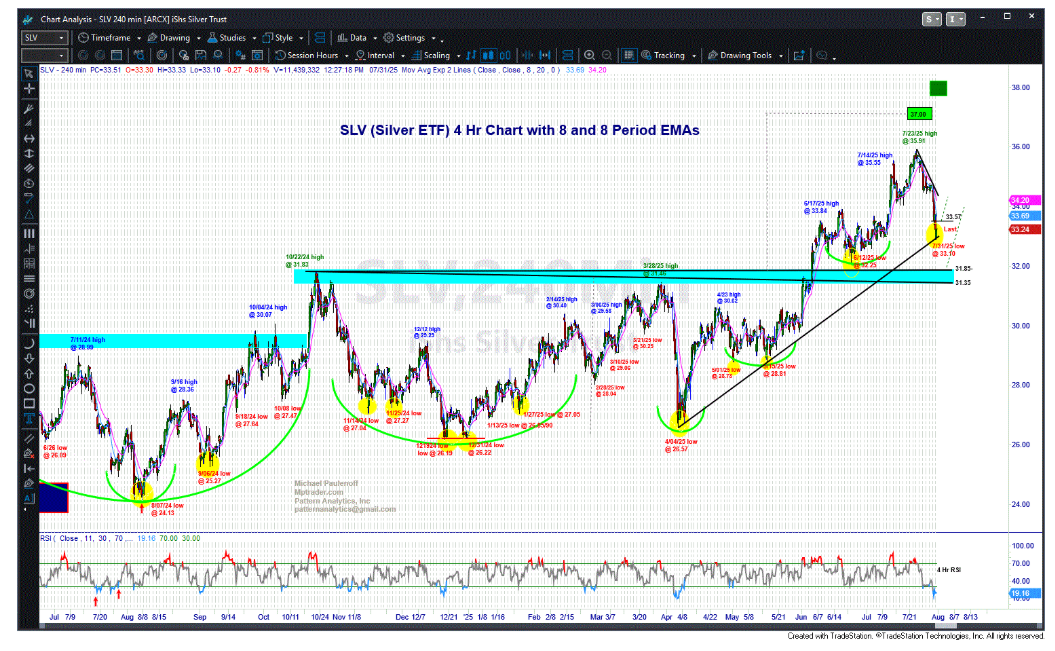

On July 31, 2025, with SLV (Silver ETF) trading at 33.27, this is what we discussed about my technical setup:

SLV-- On the subject of tariffs, copper, and silver, Trump extended the tariff deal with Mexico for 90 days, which included steel and copper, but NO MENTION of Silver (so far). Let's notice on my attached 4-Hour chart of SLV that the week-long nosedive from 35.91 to this AM's low at 33.10 held right at the April-July support line, and is attempting to find a bottom in and around 33.00-33.20. SLV needs to recover and close above 33.57 for my work to trigger an initial signal that the correction is exhausted. In the absence of a close above 33.57, should SLV weakness press below 33.00/10 support, the price structure will be vulnerable to downside continuation into the 31.35-31.85 multi-month support plateau, from where powerful renewed buying interest should emerge... Last is 33.27...

Here is the accompanying SLV Chart posted on July 31, 2025... (continued below the 7/31/25 chart)...

Fast-forward four weeks, and we see on my current SLV chart that the Silver ETF closed at the end of August 2025 (last Friday, 8/29/25) at 36.19, a full 8.8% above the price in my 7/31/25 update.

Interestingly, Silver futures are open today on the U.S. Labor Day holiday (September 1st). December Silver is trading at 41.42 as we speak, 1.7% above Friday's close and above $40 for the first time since 2010, which bodes well for a stronger opening for SLV tomorrow morning.

My attached Daily December Silver Futures Chart (see below) shows the price structure accelerating to the upside from a 5-year Cup and Handle Bottom Formation that has triggered upside projections to 44.50-45.00, and if hurdled and sustained,52.00-54.00 thereafter.

As long as any forthcoming weakness is contained above 38.40 on a closing basis (December Silver futures) and above 38.25 in SLV, my pattern work argues for higher prices in the days directly ahead (See upside Target Zones annotated on my attached charts).

Silver is strengthening at the start of September, which historically initiates a typically strong seasonal into year-end. My intermediate-term technical setup work supports a strong Q4, 2025 for Silver, especially if the silver market in particular, and commodity markets in general, find themselves anticipating a relatively dovish Fed heading into the September 17 FOMC policy decision, overlaid on a stimulative domestic agenda and a strengthening global economic environment ...

Join me and MPTraders at MPTrader.com for analysis and discussion about individual stocks, sector ETFs, macro indices, commodities, precious metals, and cryptocurrencies...